This article explores and explains what’s been happening in the world of green coffee over the last 15 months and what may happen in the future.

There may not be enough coffee

Brazil produces almost 40% of the world’s Arabica coffee. Unfortunately, Brazil’s harvest was hit by drought and frost last year. The hope was that this year’s Brazil harvest would be better. However, the size of the beans within the cherry is of concern, and the expectation now is that it will be even worse than an already reduced 35 million bags estimate. To put this in perspective, in 2020 Brazil had an all-time high harvest of almost 50 million plus bags (48.76 to be exact).

This is further complicated by the fact that the second biggest Arabica producer, Colombia, has also had two bad harvests in a row due to too much rain and floods. As if this wasn’t bad enough, there have also been logistical and worker shortage issues in both origins which have made harvesting and readying the next crop difficult.

No end is in sight, just yet

There is now increased concern that next year’s harvest in both Brazil and Colombia will also be compromised due to dry conditions in Brazil and wet conditions in Colombia. This means that the world of coffee may have to contend with a rare occurrence of three worse-than-expected harvest cycles in some of the top-producing countries.

World coffee stocks

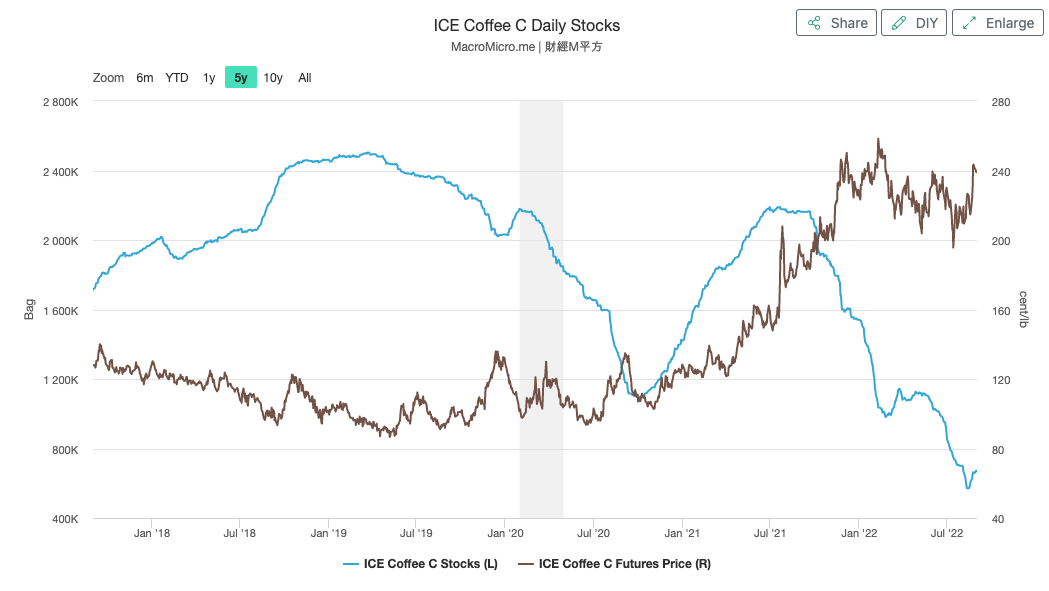

The world coffee stocks have diminished as a result of two cycles of supply deficit and demand outstripping supply. This is likely to continue for another harvest cycle if the fears about the next Brazilian and Colombian harvests come true.

Source: MacroMicro.me

Prices at all-time highs

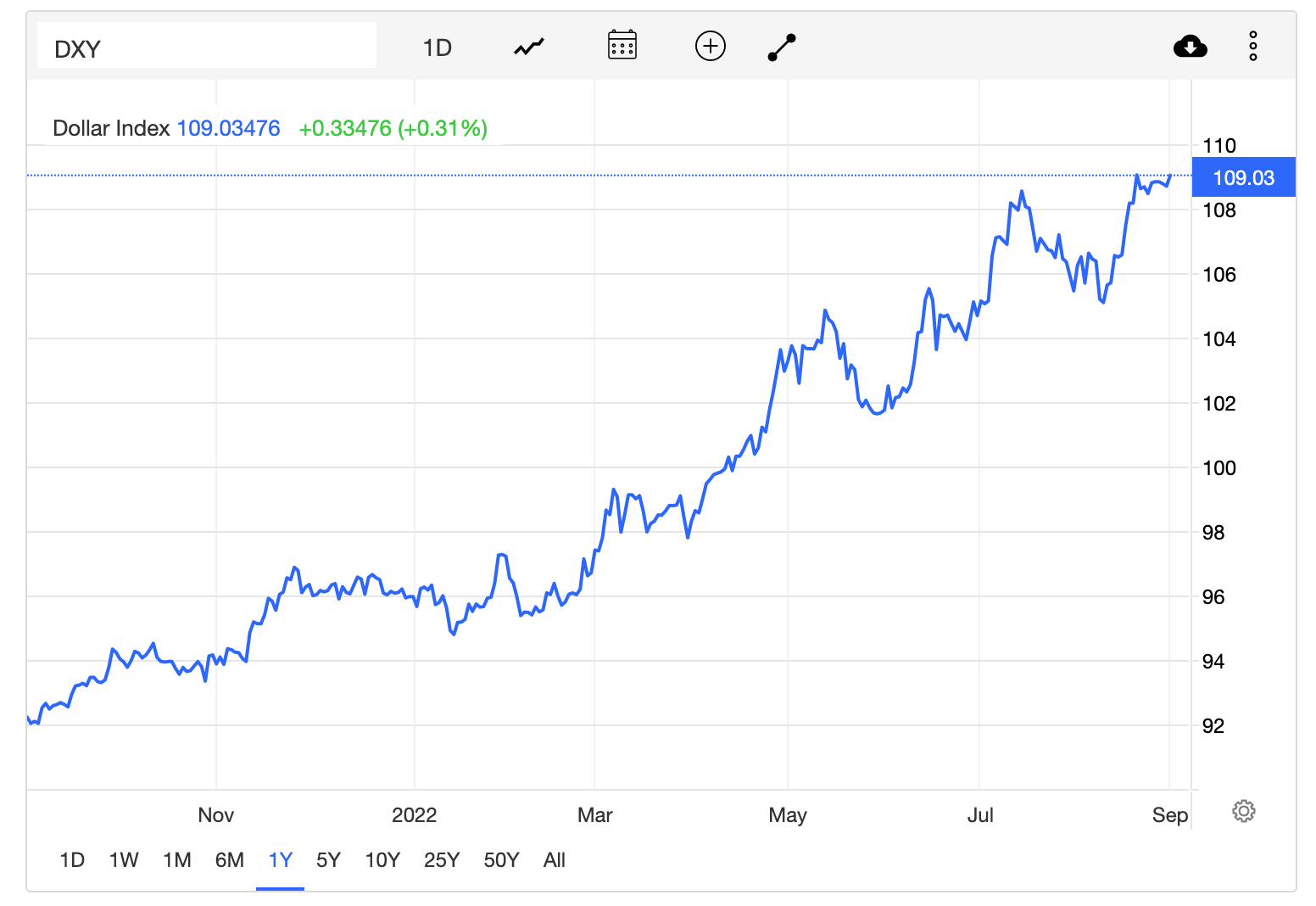

All coffee prices around the world reflect the benchmark C prices. C is a commodity futures exchange for Arabica coffee and the C price is used as a benchmark price for all coffee, including specialty coffee. This is not the price that everyone pays, however, coffee prices across the globe increase and decrease with the C price. The C price is represented in US dollars per pound.

The C benchmark price has doubled from the previous 5-year average and is looking unlikely to come down soon. There is a high likelihood that prices might stay at this level or even increase further.

Source: Trading Economics

The US dollar isn’t helping

The US dollar is also at a 20-year high. As coffee is traded in US dollars, this means that in actuality coffee prices have almost increased by 150% when the effect of the US dollar is considered. The last time coffee prices went this high was in 2011. However the US dollar was at an all-time low at that stage and most of the world, including Australia, did not see a noticeable increase in coffee prices.

Source: Trading economics

Are farmers seeing windfall profits?

This will depend on individual farm and region circumstances. Broadly speaking, that’s not necessarily the case. With lower harvest yields and increased input prices for fuel, labour and fertilizer, there is no windfall to be had. Furthermore, coffee prices have not kept up with inflation in a meaningful way over the last 30 years. A lot of progress had been driven due to increased harvest yields over the years. However, this trend has reversed over the last couple of years due to bad harvests and astronomical prices of inputs. This is a difficult time for the whole industry and supply chain. Everyone, including farmers, brokers, roasters, cafes and consumers, are in the same boat when it comes to facing the increased cost of living pressures. The industry is a resilient one and we will all get through this together. At the same time, it will need adjustments and proactively managing the new circumstances.

What’s next

Unless, the tightness of the coffee supply and the fears over the next harvest change quickly, there will be two problems. First is the amount of and type of coffee available and the second is the price of the coffee. We will see retail and wholesale coffee prices increase further as all the roasters who were able to minimise or omit price increases due to long-term buying programs will now see this higher reality of prices come through. And there will be no choice but to pass these increases on to ensure the viability of the supply chain and to ensure continuity of supply even while being creative and turning to coffee origins with better harvest results.